Liability Education Part 2:

“How Much Liability Coverage do I Need” and “How Do Limits Apply in the Event of a Loss?”

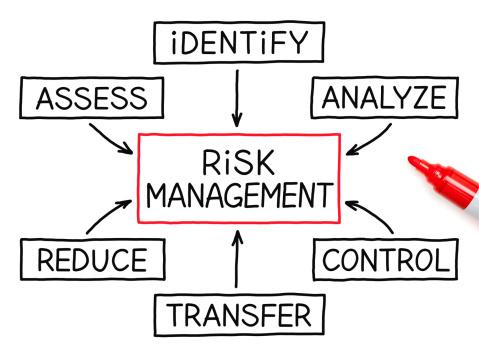

We commonly are asked the question – “How much liability coverage do I need?” To help answer this, you must first recognize and evaluate your risks. Consider the amount of risk inherently associated with your business. For example, what products/services do you offer? What is the useful life of your products/services? Who are your clients and where are your clients located? Do you subcontract component parts or services, sign lease agreements or enter into contracts with vendors and clients? Signed agreements must be reviewed to make sure your liability limits satisfy contract requirements. Good risk management can reduce the chances that your business will be sued, however it can never eliminate the risk entirely.

When reviewing General Liability policies, liability limits are shown in the policy declarations and are the most an insurer will pay to a third party due to a covered cause of loss. The insured is legally liable for any amounts above the policy limits.

Liability Limits are fixed amounts per policy term and do not increase:

- regardless of the number of insureds

- regardless of the number of claims made

- regardless of the number of persons or organizations making a claim

There are typically six different liability limits listed on a Commercial General Liability (CGL) policy:

- General Aggregate Limit

- Products-Completed Operations Aggregate Limit

- Personal and Advertising Injury Limit

- Each Occurrence Limit

- Damage to Premises Rented to You Limit

- Medical Expense Limit

Liability Limits are Interrelated:

- A reduction of one limit by the payment of damages may also reduce another limit

General Aggregate Limit:

The maximum amount an insurer will pay during the policy period for all losses except those arising from specified exposures. Under the CGL policy, the general aggregate limit applies to all covered bodily injury (BI) and property damage (PD); except for injury or damage arising out of the products and completed operations hazard.

- When paid losses reach the general aggregate limit, the limit is exhausted and no more losses in those categories will be paid under the policy

- The general aggregate limit can apply to either designated locations or designated projects

- Products and completed operations claims are paid out of a separate aggregate limit

Products-Completed Operations Aggregate Limit:

The maximum amount an insurer will pay during the policy period because of covered bodily injury or property damage arising out of the products and completed operations hazard. This limit applies independently of the general aggregate limit. Damages paid under the general aggregate limit do not reduce the products and completed operations aggregate limit and vice versa. Products and completed operations apply only to bodily injury or property damage that:

- Occurs away from the named insured’s premises and

- Arises out of the named insured’s products that are no longer in the named insured’s possession or

- Arises out of the named insured’s work that has been completed

- Ongoing Operations – work or other business activity that has not been completed or abandoned. Standard additional insured status under a general liability policy applies only with respect to liability in connection with the named insured’s ongoing operations, preventing coverage from extending to the additional insured’s liability for the named insured’s completed operations.

Think of the aggregate limits as two separate large tanks of water. Each tank flows into four smaller tanks that represent the other CGL policy limits. The aggregate tanks are full at policy inception and the other four tanks are empty.

Any time a claim is paid, the smaller tank from which the claim is paid must first draw water from the larger aggregate tank, reducing the water in the aggregate tank. Claims are paid on the policy until the aggregate tank is empty, meaning the aggregate is exhausted. Any further attempt to draw from the aggregate tank during the policy period will come up dry, the aggregate limit is exhausted.

Personal and Advertising Injury Limit:

The maximum amount an insurer will pay during the policy period because of personal and advertising injury offenses.

- Personal injury includes false arrest, detention or imprisonment, malicious prosecution, wrongful eviction, slander, libel, and invasion of privacy.

- Advertising injury refers to offenses in connection with the insured’s advertising of its goods or services including libel, slander, invasion of privacy, copyright infringement, and misappropriation of advertising ideas.

Each Occurrence Limit:

The maximum amount an insurer will pay for all claims resulting from a single occurrence, regardless of:

- How many people are injured

- How much property is damaged

- How many different claimants may make claims

An occurrence is defined as an accident, including continuous or repeated exposure to substantially the same general harmful conditions. CGL policies insure liability for bodily injury (BI) or property damage (PD) that is caused by an occurrence.

Damage to Premises Rented to You Limit:

The maximum amount an insurer will pay if the insured is legally liable for either of the following:

- Property damage only to the premises (not to the contents of the premises) if an insured is legally liable to pay for the property damage but only if fire caused the property damage (fire legal liability);

- Property damage to premises, including the contents of the premises, rented to the named insured for 7 or fewer consecutive days if an insured is legally obligated to pay for the property damage due to any cause except fire.

This is a sublimit of the each occurrence limit. Payments made under this limit will reduce the each occurrence limit and the general aggregate limit.

Medical Expense Limit:

The maximum amount an insurer will pay for reasonable medical expenses for bodily injury caused by an accident, without regard to fault.

- Applies separately to each person

- Is a sublimit of the each occurrence limit

- Payments under this limit will reduce the each occurrence limit and the general aggregate limit

Defense Costs Provisions:

- Within limits – all legal defense costs are deducted from the policy limit which reduces the amount available to pay monetary damages

- Outside limits – separate limits available for legal defense costs and monetary damages; does not erode policy limits

Our expertise can help you assess your liability risk and also determine if the nature of your business warrants additional types of liability coverages, such as Professional Liability, Errors and Omissions Liability, Environmental Liability, etc.

#teamkoppinger is here for you!