Contractual Risk Transfer (CRT)

Certificate of Insurance

Welcome back to our CRT series! The final step of an effective risk transfer program is requiring the indemnitor to provide proof of insurance to back up its commitments. This information is provided through a Certificate of Insurance (COI), a document that evidences and summarizes insurance coverage.

Why ask for a certificate of insurance?

Generally, requiring a certificate of insurance is the result of negotiation between parties, which in most cases turns into a contractual obligation.

In order to protect potential liability created by a COI, especially when a third party is being asked to be included as an additional insured, it is important to read and analyze the language of the contracts you sign.

Facts about a COI as referenced by the certificate wording below:

- it is a representation of existing coverage and does not modify or change the insurance Policy(ies)

- it is not a contract

- it does not constitute a contract of insurance between the issuing insurer(s), authorized representative or producer, and the certificate holder

Key components of a COI include but are not limited to:

- name of the insured

- insurance carrier name(s) and policy number(s)

- type(s) of coverage

- policy effective and expiration date

- coverage limits

- certificate holder name and address

Understanding Other Certificate of Insurance Provisions

(see certificate wording below)

Additional Insured

- an additional insured is a party not included as an insured under a policy(ies), but is added to the policy(ies) at the request of the named insured

- if the certificate holder is an additional insured, the policy(ies) must have additional insured provisions or be endorsed

- a statement on the COI does not confer rights to the certificate holder in lieu of such endorsement(s)

- an additional insured cannot make changes to the policy(ies)

- protection for your own liabilities may be reduced in the event of loss as the policy limits are available to the certificate holder

- could lead to relying on business assets to satisfy any legal obligations

- the policy will only respond when additional insured status is required in a written contract signed and executed prior to a loss

Waiver of Subrogation

- an acknowledgement by an insurer that it has no right to subrogate against a liable third party after it has paid a loss on behalf of its insured

- it is important to note this stands even when the certificate holder is directly responsible for the damages

- it is subject to the terms and conditions of the policy, certain policies may require an endorsement

- a statement on the COI does not confer rights to the certificate holder in lieu of such endorsement(s)

- the policy will only respond when waiver of subrogation is required in a written contract signed and executed prior to a loss

Primary and Noncontributory

- endorsement or policy language that makes a specific insurance primary when multiple policies triggered by the same loss are required to respond

- a statement on the COI does not confer rights to the certificate holder in lieu of such endorsement(s)

- noncontributory means the policy will not seek contribution from any other collectable policy in order to cover the claim

- the policy will only respond when primary and noncontributory is required in a written contract signed and executed prior to a loss

Policy Cancellation

- must be added by endorsement and states if the policy is cancelled earlier than the expiration date, the certificate holder will be notified

- a statement on the COI does not confer rights to the certificate holder in lieu of such endorsement(s)

- The standard number of days notice before cancellation is 30, but can vary

- the policy will only respond when direct notice of cancellation is required in a written contract signed and executed prior to a loss

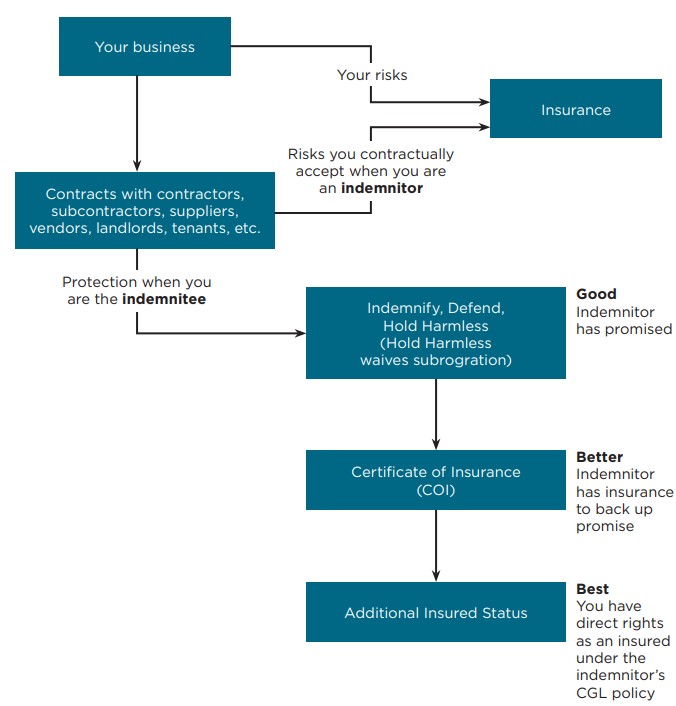

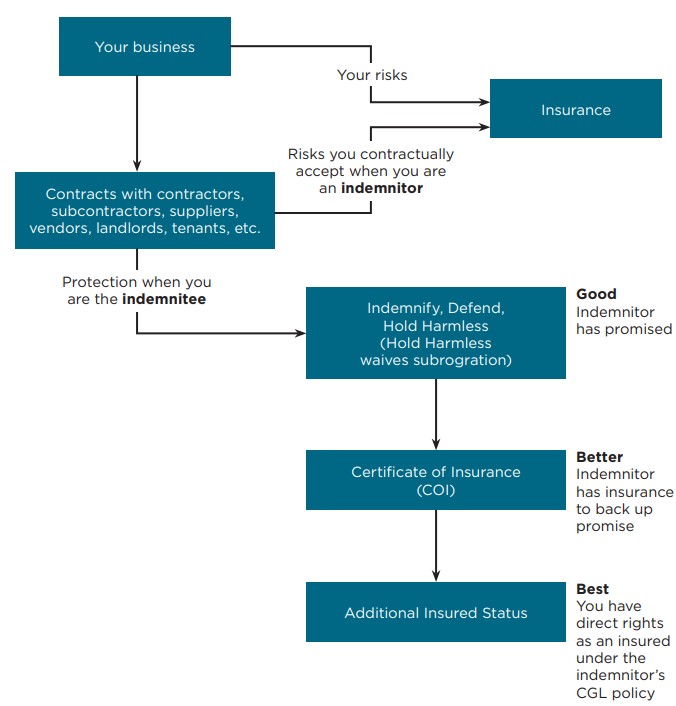

Good - Better - Best

The graphic below outlines the components of contractual risk transfer and how it works. Part 1 of our series discussed the good, Part 2 discussed the better, and Part 3 discusses the best ways to manage third party risk.

This wraps up our series on Contractual Risk Transfer. While not a mandatory document, a certificate of insurance can prove to be a valuable asset when it comes to establishing trust and confidence in your business relationships. It showcases your commitment to protecting yourself and those you work with from potential risk.

Remember, it is important to engage the services of your insurance advisor and business attorney to review any contracts you contemplate. If a contract you sign contains requirements, limits, or terms you cannot insure or choose not to purchase coverage, the contract requirements still apply as discussed in our Breach of Contract update.

Secure your business assets, transfer your risk

Koppinger & Associates has resources to help you proactively manage contractual risk

Contact us to help you build a competitive edge