May 31 2023

Categories: P&C Solutions

Risk Transfer: Managing Third Party Relationships

Critical to Protecting your Business

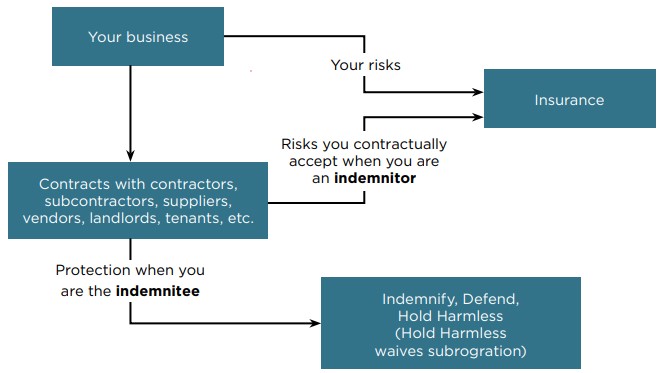

Contractual Risk Transfer (CRT) is accomplished through a combination of provisions negotiated between businesses at the beginning of their relationship before a loss or claim occurs.

One of the most important steps in CRT is to have a written, signed, and binding contract in place that spells out the terms, commitments, expectations, and legal requirements of the relationship.

Consider the following questions when determining the type of risk transfer that is best for you:

There are many, but the most common types of clauses that are contractually used to allocate risk effectively include:

Within the CRT process, the contract will require the indemnitor to obtain and provide proof of insurance to back up its commitments. We will discuss Certificates of Insurance and requesting Additional Insured status in our next update. Stay tuned for the final segment of our series.

Managing risks makes you less likely to be faced with financial and reputational loss

Clear up the confusing world of CRT with #TeamKoppinger

Contact us to discover the many benefits of a partnership with Koppinger & Associates

flowchart: Cincinnati Insurance Companies